According to the 2019 research published by the Fintech and Insurtech Observatory at MIP, the School of Management of Politecnico di Milano, there are 326 active fintech and insurtech start-ups in Italy, which have raised overall € 654 million since the beginning of their operations.

The research then focuses on 149 start-ups that provided information on their business models (representing 46% of the total), and which have received € 482 million (74% of the overall capital raised).

The main results are the following:

- 42% of the analysed start-ups operate in the banking industry (mainly providing solutions such as: bank accounts, wallets & payments, personal finance management, and lending & financing); 35% of the start-ups offer investment services; 21% of them offer insurance services; other services such as technology solutions oriented to the financial and insurance world (marketing, proptech and regtech, etc) are offered by 25% of the analysed start-ups.

- The most used technologies are web platforms (68%) and APIs (62%). Other used technologies are big data analytics (55%) and artificial intelligence (50%).

- 72% of the analysed start-ups have partnerships: 50% with non-financial partners, 40% with financial partners – to provide banking services – and 27% with other start-ups – to provide technologies.

- Geographically, 55% of start-ups operate only in Italy.

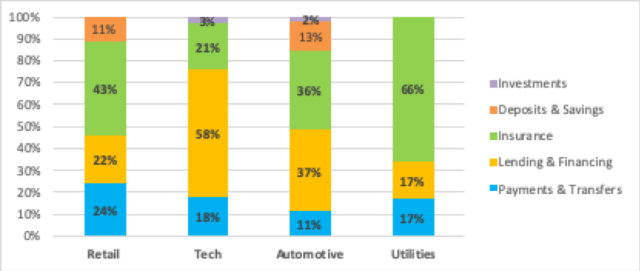

Moreover, the Observatory analysed the fintech and insurtech services offered by 55 non-financial companies operating in 4 sectors: tech, automotive, utilities and retail. These services are developed either internally or in partnership with other financial companies. The chart below shows the breakdown of the fintech and insurtech services for each sector.

Most of these companies (45%) offer only financial services strictly connected to their core businesses, but 35% of them offer financial services that are also related to other non-core activities. These latter companies are defined “Open Finance Oriented” companies. Other companies, representing 18% of the analysed sample, offer financial services completely disconnected from their core businesses; these companies are defined “Explorers”.

On the consumer side, the Observatory estimated that 12.7 millions of Italian people (29% of the entire Italian population aged between 18 and 74) used at least one fintech and insurtech service in 2019. The most used services were mobile payments and chatbots.

Furthermore, Italian SMEs are still behind in the use of fintech products: 36% of Italian SMEs have never used fintech solutions, as they prefer to access to financial products through physical channels.

For the future, Italian start-ups are expecting (a) the implementation of the Italian Regulatory Sandbox introduced in June 2019, and (b) more collaboration with banks and financial institutions, following the introduction of the PSD2 (Payment Services Directive 2).

SUBSCRIBE TO THE SCALEUPITALY NEWSLETTER

You can find the more details on the analysis at the following link: https://www.osservatori.net/ww_en/observatories/fintech-insurtech